vehicle personal property tax richmond va

Yes contact the Business Tax Section of the Chesapeake Commissioner of the Revenue Office 306 Cedar Road. The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for disabled persons.

Fill Free Fillable Port Of Richmond Virginia Pdf Forms

Click on the link for Personal PropertyMVLT and Real Estate.

. Stafford DMV Select is located in the Treasurers Office Monday Friday 800 am 300 pm Walk-ins are welcomed. Steps to viewprint property tax payment information. DMV Customer Service can be reached by calling 804497-7100 or by visiting wwwdmvvirginiagov.

After contact continue to 16. Real Estate and Personal Property tax payment information is available on our website unless you have opted out of listing your real estate tax information. 757-382-6739 for information concerning the taxation of business personal property.

Vehicle Title transactions will be limited to 2 title transactions per person. Click on Payments circle on Citys home page or click here. Personal Property Tax.

DMV Selects do not issue or renew drivers licenses learners permits or. If a vehicle is subject to the taxes in Alexandria for a full calendar year the tax amount is determined by multiplying the tax rate by the assessed value.

Bankruptcy Lawyer Richmond Va Tax Attorney Attorneys Intellectual Property Law

Formerly Redlined Areas Of Richmond Are Going Green Chesapeake Bay Foundation

How Decades Of Racist Housing Policy Left Neighborhoods Sweltering The New York Times

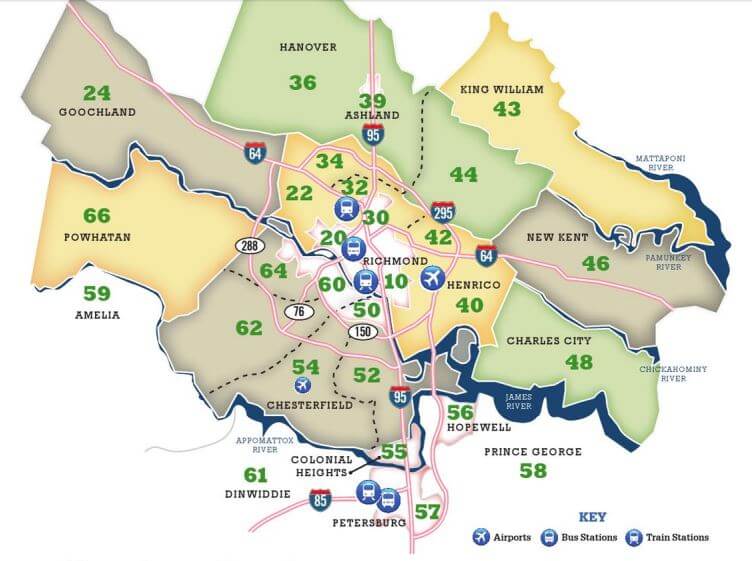

Guide To Richmond Area Mls Real Estate Zones Mr Williamsburg

Fill Free Fillable Port Of Richmond Virginia Pdf Forms

Richmond Property Tax 2021 Calculator Rates Wowa Ca

How Decades Of Racist Housing Policy Left Neighborhoods Sweltering The New York Times

Free Closing Disclosure Conditional Release Option Form Real Estate Forms Template Printable Good Essay